About Allied for Success

Create a synergy of financial planning specialists to fulfill our clients’ dreams. Allied for Success addresses the benefits, processes, and barriers to building Purpose-Centered Alliances with clients

Four Principles of a Purpose-Centered Alliance

At the outset, I want to clearly define and describe four principles of a purpose-centered alliance. We will refer back to these many times throughout the book to provide richer insights and to show practical ways to build these relationships with clients. The four principles are:

-

A purpose-centered alliance is built on trust, not sales techniques.

Sales skills are valuable, but they are secondary to two traits that are absolutely essential in building trust in any relationship: character and competence. Your trustworthiness and your access to detailed knowledge of products are far more important than any sales technique.

-

The foundation of a purpose-centered alliance is your own clear, compelling sense of purpose.

As the old saying goes, “You can’t give away what you don’t possess.” Similarly, you probably won’t be able, or even be motivated, to uncover your clients’ dreams and purposes if your own are buried or vague.

-

The process of building a purpose-centered alliance requires a clear plan, a few skills to help you uncover clients’ dreams, and persistence in making those dreams come true.

As I have communicated these principles with others, the vast majority of them have said things like, “This is a breath of fresh air! This is what I got into financial services for in the first place! Thank you for bringing me back to what I do best: caring for people, building solid relationships with them, and helping them fulfill their dreams.” And one person told me, “This makes perfect sense. Why would we do it any other way?”

-

The benefit of building purpose-centered alliances is that people will trust you with their dreams and their assets.

It may seem like a paradox to some of us, but when we take our focus off our own desire to make a sale and put our focus on others’ dreams, we become more fulfilled because we actually help people. We are less stressed because we are simply doing what we do best, and as people trust us with more of their assets, we make more money, too.

When you start using these principles, you’ll say the same thing I did, “This is fantastic! Why didn’t I figure this out a long time ago?” . When these relationships are built, suspicions and jealousies melt away, and an alliance works beautifully. It’s rewarding to refer clients to other professionals we trust, and it’s fulfilling to hear clients call back to thank us for connecting them to another professional who met their specific need.

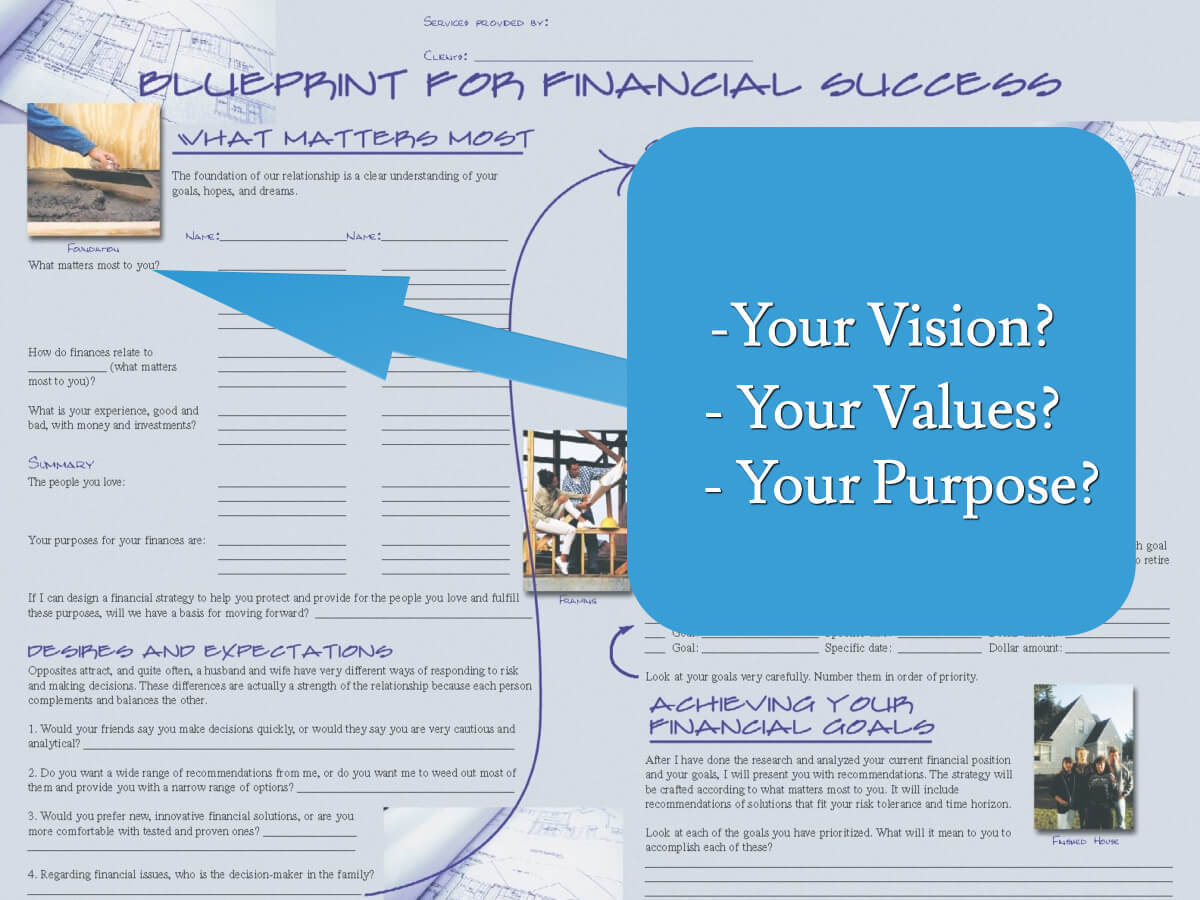

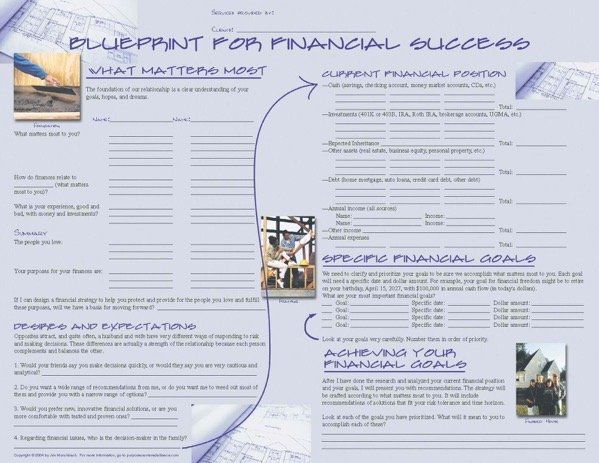

The Blueprint for Financial Success

A Comprehensive Guide for DIY Investors, Families, and Small Business Owners.

The Blueprint for Financial Success: An Overview

The Blueprint for Financial Success is a holistic framework that covers every aspect of your financial journey. Whether you are a DIY investor, a family looking to secure your financial future, or a small business owner aiming for financial stability, this blueprint serves as your roadmap to success. Let’s delve into each component of the blueprint and understand its significance in your financial planning process.

1. Financial Independence or Retirement Planning

One of the primary goals for many individuals is achieving financial independence or planning for a comfortable retirement. The Blueprint for Financial Success guides you through the process of setting specific retirement goals, determining the required savings, and implementing strategies to maximize your retirement funds. We provide insights into retirement accounts, investment options, tax-efficient withdrawal strategies, and other crucial considerations to ensure you have a solid plan for your golden years.

2. Risk Management or Insurance Planning

Protecting yourself, your family, and your assets against unforeseen events is a critical aspect of financial planning. The blueprint emphasizes the importance of risk management and guides you in assessing your insurance needs. We help you understand different insurance policies, such as life insurance, health insurance, property insurance, and liability coverage. By evaluating your risks and identifying suitable insurance solutions, you can safeguard your financial well-being and achieve peace of mind.

3. Estate Planning

Planning for the distribution of your assets and the preservation of your legacy is vital for individuals and families alike. The Blueprint for Financial Success highlights the significance of estate planning and provides guidance on wills, trusts, powers of attorney, and other essential estate planning tools. We help you navigate the complexities of estate taxation, asset protection, and the transfer of wealth, ensuring that your wishes are fulfilled and your loved ones are taken care of.

4. Education Planning

Investing in education is a significant financial goal for many families. The blueprint offers strategies and insights to help you plan and save for your children’s education. We explore options such as 529 plans, Coverdell Education Savings Accounts, and other tax-advantaged savings vehicles. By incorporating education planning into your financial journey, you can provide your children with the best educational opportunities without compromising your long-term financial stability.

5. Tax Planning Strategies

Optimizing your tax liabilities is a key aspect of financial planning. The blueprint equips you with valuable tax planning strategies to minimize your tax burden legally. We cover topics such as deductions, credits, tax-efficient investments, and retirement account contributions. By employing effective tax planning strategies, you can maximize your after-tax income, preserve more of your hard-earned money, and accelerate your progress towards your financial goals.

6. Investment Management Strategies

Building and managing a diversified investment portfolio is essential for long-term financial success. The blueprint provides insights into various investment options, asset allocation strategies, and risk management techniques. We guide you through the investment selection process, taking into account your risk tolerance, time horizon, and financial objectives. With our investment management strategies, you can optimize your returns while mitigating risk.

7. Cash Flow Management

Effectively managing your cash flow is the foundation of sound financial

planning. The blueprint emphasizes the significance of budgeting, expense tracking, and debt management. We provide practical tips and tools to help you streamline your cash inflows and outflows, ensuring you have a healthy financial foundation. By mastering cash flow management, you can achieve financial discipline, reduce debt, and create opportunities for wealth accumulation.

Conclusion

The Blueprint for Financial Success by BayRock Financial provides a framwork for your Financial Planning Journey. The Blueprint is a powerful tool to help you Save More Money, Pay Lower Taxes, And Build a Better Retirement.

Whether you are a DIY investor, a family, or a small business owner, this comprehensive framework covers every aspect of the financial planning process. By leveraging this blueprint, you can save more money, pay lower taxes, and build a better retirement. Take the first step towards securing a prosperous future by implementing The Blueprint for Financial Success today.

About The Blueprint for Financial Success

The Blueprint was created by Jim Munchbach, CFP® Professional as a tool to help individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose.

The Blueprint is for…

-

Individual Investors who want to build a better retirement plan

-

Families who want to equip the next generation

-

Financial Advisory teams who want to deliver Smarter Strategies and Better Results

Meet Jim Munchbach

Hi, I’m Jim Munchbach, Founder and CEO at Munchbach Family Office in Friendswood, Texas. I’ve been providing financial services since 1989. I created the Blueprint to help individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose.

How It Works

Subscribe to our email list to get access to our weekly checklists, guides, and retirement strategies.

If you’re not ready to trust us with your email address, listen to our Podcast in iTunes and everywhere podcasts are played.

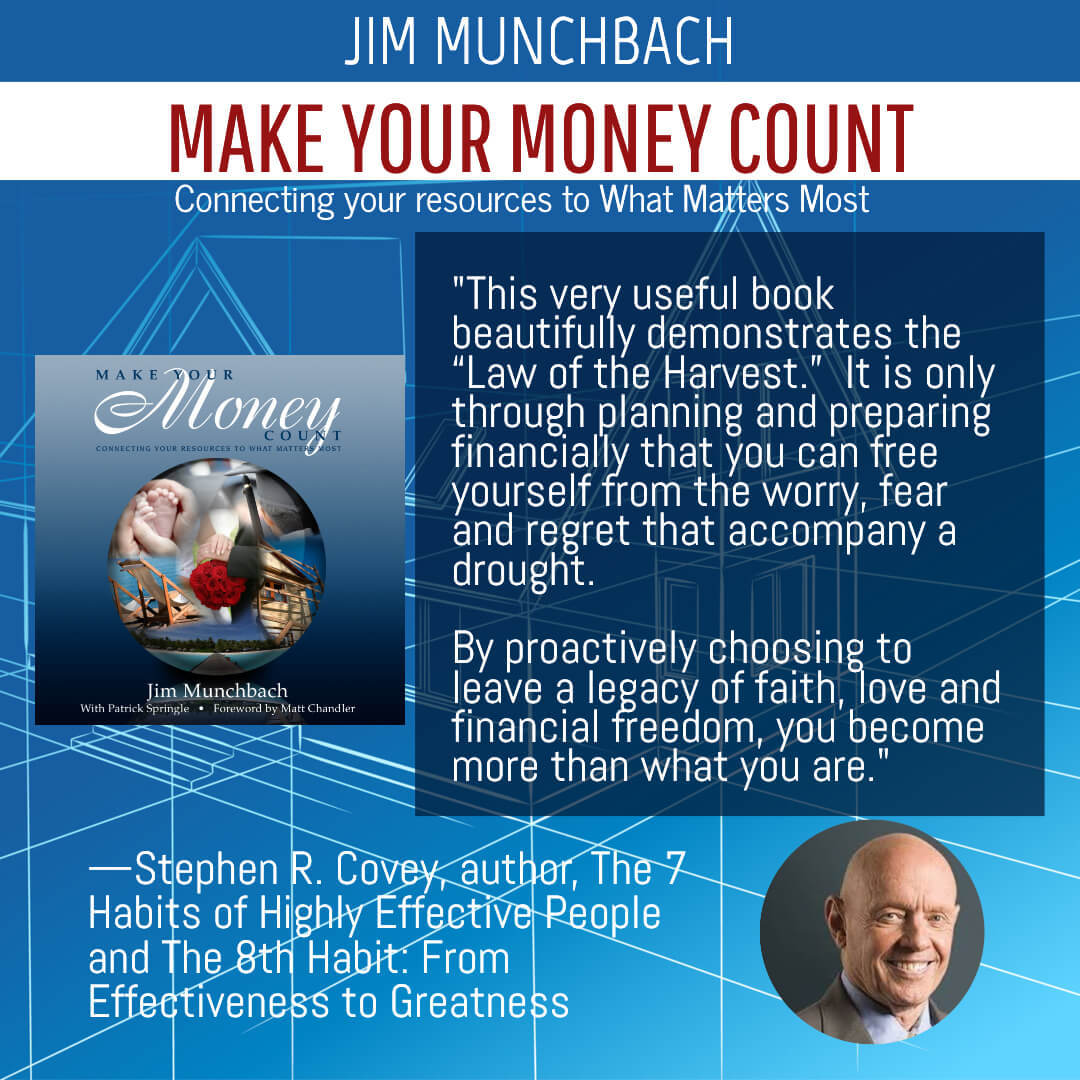

What others say about Make Your Money Count

This very useful book beautifully demonstrates the “Law of the Harvest.” It is only through planning and preparing financially that you can free yourself from the worry, fear and regret that accompany a drought. By proactively choosing to leave a legacy of faith, love and financial freedom, you become more than what you are.

—Stephen R. Covey, author, The 7 Habits of Highly Effective People and The 8th Habit: From Effectiveness to Greatness

“Jim has a gift. He can write about money and life in a way that will change how you manage both. Read him and watch God change your heart!”

— John Ortberg, Pastor – Menlo Park Presbyterian Church

“Make Your Money Count stands out from other guides on money management because it drives home an important truth: Clarifying your purpose in life is the essential element in financial planning. The book offers an excellent blueprint for success and provides easy-to-follow steps that will align your money with your best intentions and put your finances in divine order.”

—Ken Blanchard, co-author of The One Minute Manager® and Leading at a Higher Level

“Jim’s heart and values speak clearly as he integrates biblical principles into the 21st century opportunities and problems of managing money. He weaves practical points through magnetic stories, making it a must read for anyone who wants to finally get it right financially!”

—Judy Santos , Master Certified Coach, Founder and President – Christian Coaches Network Inc.

“As trusted advisors, we recognize that motivation is the key to change. In Make Your Money Count, Jim Munchbach provides powerful motivations to connect our finances with our purpose in life. This, I know, makes all the difference in the world. I enthusiastically recommend Jim’s book”

— Ron Blue , President, Christian Financial Professionals Network CFPN

“This book shows you how to get complete control over your money and your life, develop a financial plan and achieve complete independence.”

— Brian Tracy – Author – The Way To Wealth

“Make Your Money Count is a book for every person interested in a “holistic” view of money, possessions and the abundant life. Jim Munchbach has effectively zeroed in on the critical elements of living our financial lives wisely. I fully expect this book will change the way you think about money and I highly recommend it. “

— Dave Briggs, Director of the Stewardship Ministry at Willow Creek Community Church

“Jim has a way of communicating simple, practical truths so they change our lives. His compelling writing style and stories breathe life and hope into our efforts to manage money. I recommend this book to people of all ages who want to be more intentional about their finances . . . and their lives.”

—Linda Miller , Global Liaison for Coaching, The Ken Blanchard Companies !

“Jim should have titled the book Make Your Life Count because he goes beyond showing you how to manage your finances. He opens our eyes to see what is really important in life —how money and investments can help us reach our life’s goals.”

— Tom Wright, State Farm agent and author: Stop Selling And Start Marketing !

“More than any other book on the market, Make Your Money Count will help you align your money with your heart. With compelling stories and a practical “blueprint” Jim Munchbach will inspire and equip you to manage your finances with fresh vision and purpose.”

— Rick Baldwin, Sr. Pastor, Friendswood Community Church *

Books Featuring The Blueprint

The Salty Advisor playlist will include a collection of powerful stories featuring Women of Wealth, Business Leaders, and Financial Planning Professionals who have experienced personal transformation as a result of Executive Life Coaching authentic community. The Blueprint for Financial Success™ is a tool designed by Jim Munchbach, CFP® Professional. The Blueprint is the result of Executive Life Coaching with Doug Carter at the Doug Carter Summit.

Make Your Money Count

Featuring The Blueprint for Financial Success™, Make Your Money Count will help you connect your resources to What Matters Most.

What Matters Most for Financial Advisors

Trust is What Matters Most in any relationship. For any professional who makes their living selling financial advice, The Blueprint for Financial Success™ is a powerful tool. Learn more with a copy of What Matters Most by Jim Munchbach, Certified Financial Planner™.

Allied for Success

Creating a Synergy of Specialists to Fulfill Our Clients’ Dreams by Jim Munchbach, CFP® Professional. Published by FPA Press.

Trust Training for Financial Advisors

Sign up to get notified as we move closer to launching our Trust Training and Sales Training Programs for Financial Advisors and Advisory Teams.