Missional Money Membership Offer

Missional Money Membership for DIY Investors, and Financial Advisors. Get full access to our RightCapital Planning Portal, all Premium Courses, Make Your Money Count, The Blueprint, and much more. Lock in our introductory price of $24.95 per month.

Quick Announcement, special early access for our email subscribers. In just three days we will launch our Missional Money Membership campaign. For a limited time, you can secure your Life Membership at the introductory price of only $24.95 per month.

With your help and support, we will be able to achieve a few items on our BucketList and more importantly, we will be able to help hundreds of DIY Investors, Families, and Small Business Owners achieve What Matters Most on their BucketList as well.

This special offer is for friends, family, and associates but because you’re on our email list, you’re welcome to invite any of your friends, family, or associates to Join Us in July.

Here are some reasons to sign up for a Missional Money Lifetime Membership:

-

Lock in at the Introductory Low Price of only $24.95 per month for Life

-

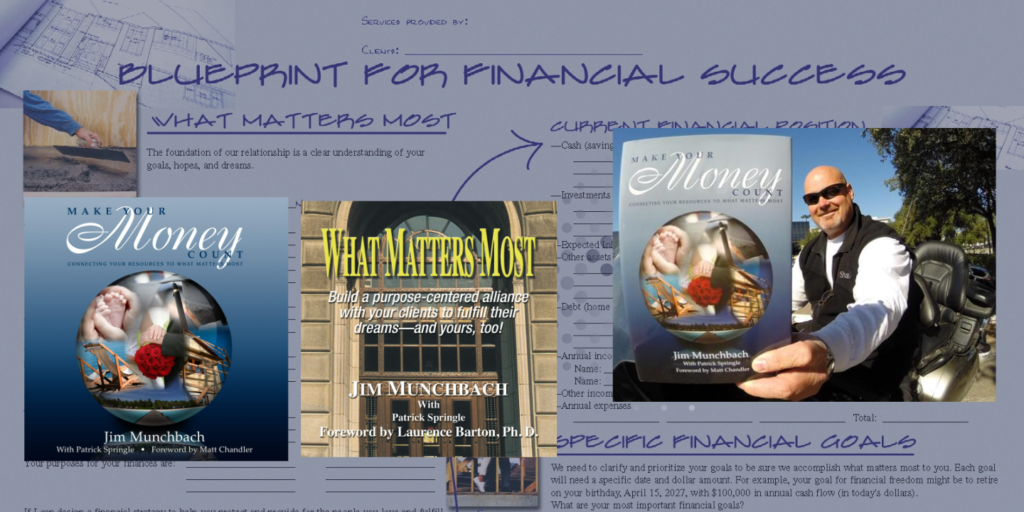

Special, Limited, Hard cover edition of Make Your Money Count

-

Access to all Premium Courses available on our Thinkific Platform

-

Current Premium Courses included (Many More to Come):

-

Missional Money Financial Planning for DIY Investors

-

What Matters Most for Financial Advisors

-

Money Study Group for College Grads

-

WealthCare Resource Library

-

MacProMax 12 Weeks to Master Your MacBook Pro

-

#AskMeAnything Weekly Zoom Meeting

-

Premium Financial Planning Portal by BayRock and RightCapital

-

The Missional Money Podcast – Member #AskMeAnything Interviews

-

The Salty Advisor Podcast – Member #AskMeAnything Interviews

By joining our dedicated group of supporters, you will have exclusive access to #AskMeAnything, backstage production, and the opportunity to help us develop our menu of Premium Courses.

Join us today and be part of the excitement as we launch our first set of Premium Courses designed to help DIY Investors, Families, and Small Business Owners Save More Money, Pay Lower Taxes, And Build a Better Retirement.

When you refer your Financial Advisor, we’ll send them a special, limited, hard cover edition of What Matters Most by Jim Munchbach along with lifetime enrollment to What Matters Most for Financial Advisors.

Missional Money Membership is designed to help for Investors, Families, and Small Business Owners work together with your Financial Advisory Team to help you Make Your Money Count.

Missional Money Membership is also for Financial Advisors

We have included What Matters Most for Financial Advisors in our Missional Money Membership package. What Matters Most for Financial Advisors is part of our Missional Money Community Bundle for $24.95 per month. Get full access to our Premium Planning Portal, Online Courses, a copy of What Matters Most, The Blueprint, and much, much more.

What Matters Most for Financial Advisors

Trust is What Matters Most for any relationship and when it comes to Financial Planning and Investment management, trust is really What Matters Most. Independent Fiduciary Advisors are not easy to find but we wanted to do our part to make a difference in the financial services industry. So, we’ve included What Matters Most for Financial Advisors in our Missional Money Membership program. We’re getting an early jump start on our Join in July campaign with these funny tweets about Trust. We hope they make you LOL.

Trust Me, but I’m NOT an Independent Fiduciary Advisor

-

Financial Advisors at big banks on Wall Street who get paid based on selling insurance policies and stock trading commissions? It’s like getting investment advice from a magician who specializes in disappearing funds. 🎩💼💰 #TrustMe #NotFiduciary

-

“Invest with me, and I’ll make your money disappear… into a magic hat!” – said no reputable Financial Advisor ever. 🐇💼 #TrustMe #NotFiduciary

-

When a Financial Advisor’s paycheck depends on selling insurance policies and earning stock trading commissions, it’s time to question if they have your best interests at heart or just their own pockets. 💰💼 #TrustMe #NotFiduciary

-

Meeting with a Financial Advisor at a big bank on Wall Street who’s all about selling insurance policies and trading stocks? It’s like having a double dose of financial confusion in one sitting. 🤷♂️💼📈 #TrustMe #NotFiduciary

-

“Trust me, this insurance policy will protect your financial future… and these hot stock tips will make you a millionaire!” – said every overly confident Financial Advisor ever. 💼🚀 #TrustMe #NotFiduciary

-

Financial Advisors at big banks who prioritize selling insurance policies and stock trading commissions might have more charts and graphs than actual financial wisdom. 📊📈💼 #TrustMe #NotFiduciary

-

If a Financial Advisor’s favorite emoji is the 💸 and their main conversation topic revolves around trading stocks and selling insurance, it’s time to question their expertise. 🤔💼 #TrustMe #NotFiduciary

-

“Why settle for a stable investment portfolio when you can try your luck on the stock market?” – said the Financial Advisor who believes in financial roulette. 🎲📈💼 #TrustMe #NotFiduciary

-

Want to experience the thrill of a rollercoaster ride? Just let a Financial Advisor from a big bank trade your stocks and sell you insurance policies. 🎢📉💼 #TrustMe #NotFiduciary

-

When a Financial Advisor’s primary focus is selling insurance policies and earning stock trading commissions, it’s like hiring a chef who only knows how to make peanut butter and jelly sandwiches. 🥪💼 #TrustMe #NotFiduciary

-

“I can help you build a diverse portfolio… consisting of insurance policies and volatile stocks!” – said the ambitious Financial Advisor who believes in a chaotic approach to wealth management. 🌪️💼 #TrustMe #NotFiduciary

-

Trusting a Financial Advisor who prioritizes selling insurance policies and earning stock trading commissions is like letting a squirrel manage your investment portfolio. 🐿️💼💸 #TrustMe #NotFiduciary

-

Meeting with a Financial Advisor at a big bank who’s all about selling insurance and trading stocks? Brace yourself for a financial advice session that’s more chaotic than a game of Jenga. 🏦📈💼 #TrustMe #NotFiduciary

-

“Why settle for a comfortable retirement when you can gamble your savings on the stock market?” – said no responsible Financial Advisor ever. 🎰💼 #TrustMe #NotFiduciary

-

Financial Advisors at big banks who focus on selling insurance policies and earning stock trading commissions might have more emojis in their emails than actual sound investment strategies. 📧💼 #TrustMe #NotFiduciary

-

If your Financial Advisor starts their meeting by asking if you’re interested in insurance policies and high-risk stock trading, it’s time to consider finding a more balanced advisor. 💼🤷♀️ #TrustMe #NotFiduciary

-

Want to hear some creative sales pitches and questionable stock tips? Just sit down with a Financial Advisor from a big bank who thrives on selling insurance and playing the stock market. 💼🎢📉 #TrustMe #NotFiduciary

-

“Trust me, this insurance policy will protect you from all financial risks… and these stocks will make you the next Warren Buffett!” – said the overly confident Financial Advisor who should stick to magic tricks. 🎩💼📈 #TrustMe #NotFiduciary

-

When a Financial Advisor suggests buying insurance policies and chasing volatile stocks, it’s time to remember that financial stability doesn’t come from magical illusions. 🪄💼 #TrustMe #NotFiduciary